Alexandra Mezhonova, Eastern Europe marketing manager at Forward3D, and Hannes Ben, EVP international, offer an in-depth view of the Russian market.

Introduction

Russia has long been among the leading global nations in terms of the number of internet users, its growing ecommerce sector and relatively fast broadband.

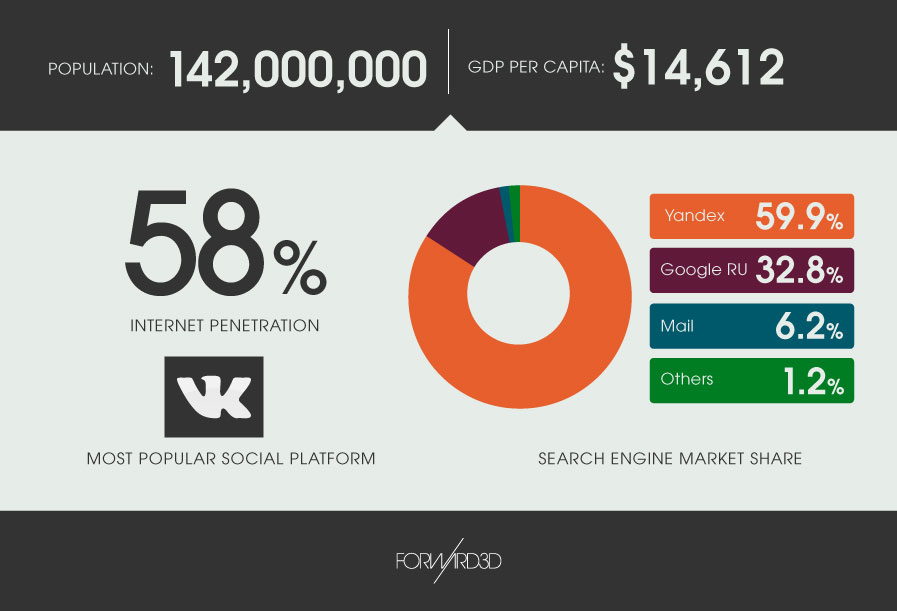

Russian online shoppers are experienced in interacting with both global and domestic media channels. The region has developed a distinct online environment, combining well-known global platforms with its own popular services such as the domestic search engine, Yandex, social media platform VK, as well as smaller players such as Odnoklassniki and Mail.ru.

Why Russia?

Russia has the scale that is lacking in many of the European markets, with over 10 million more internet users than the next largest market, Germany.

This is actually in spite of its relatively modest internet penetration rate of around 60% (highly concentrated around Moscow and St Petersburg), which means that there is also still the potential for vast growth in Russian ecommerce, as the adoption of online shopping and distribution infrastructure continues to grow.

Russia’s luxury sector is more developed and more European in nature than many of those across APAC.

The numbers inside of Russia do not tell the full story either, as the surrounding countries (often referred to as the CIS) have piggy-backed on Russia’s well developed search and social platforms to also develop into promising ecommerce environments. The linguistic and online behavioural similarities in these markets mean that advertisers can easily expand their reach beyond Russia’s borders with a considered strategy.

For luxury brands in particular, Russia has consistently delivered high AOVs and affluent customers here are among the highest in terms of top-of-mind awareness of foreign luxury brands. This is simply because its luxury sector is more developed and more European in nature than many of those across APAC.

The Russian economy

Advertisers have rightly been concerned by the ongoing economic situation in Russia, which has created headlines surrounding the weakened ruble, higher unemployment rates and lower disposable income. But these worries are mitigated somewhat with a full appreciation for how this is impacting on observed customer behaviour.

In the travel industry, for example, customers are generally spending more time on travel aggregator sites to identify the best deals and then booking online in higher numbers rather than consulting offline travel agencies.

While the AOV for online retailers has dropped overall, it is still relatively strong compared to other Eastern European and Asian countries. For luxury brands especially, customers still prefer to buy online simply because the majority of these products are far more expensive in stores.

Online landscape

Digital marketing in Russia is highly complex and requires expertise across the platforms unique to this market. Yandex is the major search engine with around 60% of the market share, followed by Google with around 33% and 7% of searches are conducted on mail.ru or others.

The good news for advertisers is that CPCs are typically far lower on Russian platforms compared to the more global ones, meaning your budget will usually stretch further.

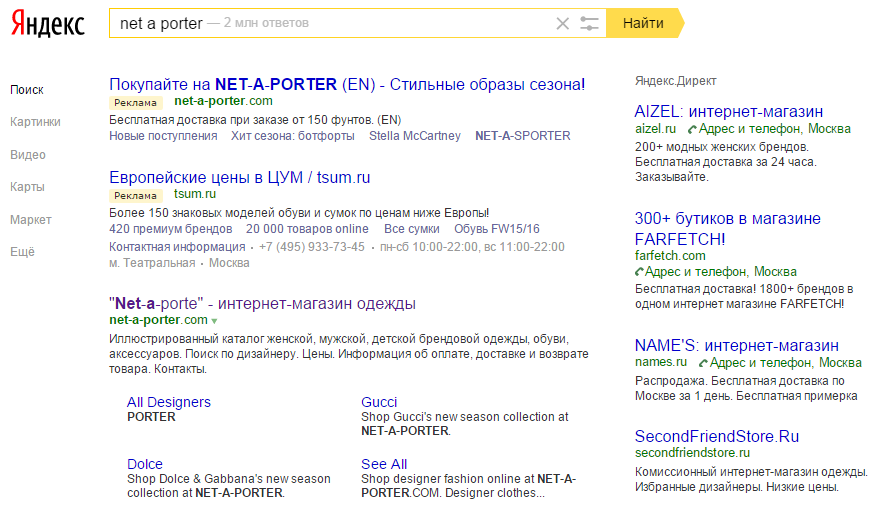

The Yandex SERP is quite similar to Google (see below) in that it offers paid text ads at the top and right-hand side, with a few lines of text and site links.

However, additional formats such as media context banners can also be triggered by keywords in the same way as text ads, and these share the same space on the right hand side.

Organic meta content results can be managed via Yandex webmaster tools and this allows brands to not only control the title and description, but also the favicons and site links. Yandex assigns much more importance to meta content than Google does, and this is a common mistake made by marketers accustomed to only working with Google.

Marketers searching for English language guides to Yandex advertising should also be aware that the search engine very recently launched major changes to how its PPC auction system operates.

Social media and VK

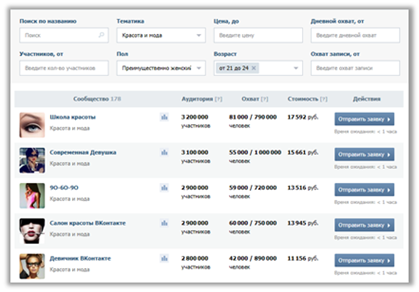

Russians spend 10-plus hours on social networks every month (second in the world), which represents a huge commercial opportunity for advertisers wanting to reach a Russian audience, particularly those new to the market and without a high level of brand awareness.

The typical options open to advertisers include biddable targeting options (PPC), which appear in users’ newsfeeds, and the Paid Post Marketplace (PPM), which allows brands to target communities and discussion boards that are based on specific interests on the social network.

In the following, you can see an example of the typical VK PPC social biddable formats:

Below are some example communities within the VK PPM, which allows brands to quickly reach relevant audiences on a large scale:

Summary

While it is true that Russia has suffered as a result of the economic downturn, it remains a key market for international brands and has proven that it can still perform and grow if you carefully identify, select and optimize the most relevant channels as well as appreciate how consumer behaviour is adapting to the ongoing situation.

For brands new to the market, the key challenge is finding the right balance between branding and direct response activity, and then adapting accordingly based on the results of campaigns.

With a strong understanding of the platforms used and the local ad formats required, brands can still succeed in Russia and the market offers a strong growth opportunity for online businesses.