The sword of Damocles that is the Snap IPO has been hanging over our heads for months now, with all industry eyes on its comically-filtered blade. As the result drops, is Snapchat’s parent company worth its exceptionally generous valuation? Anna Dobbie reports.

Snapchat – you either love its deer filter or you don’t use it. Personally, I’m a Snapper. However, a selection of reasons my friends/colleagues/random strangers I pinned down for long enough to interrogate have given for not joining are as follows:

* “My friends don’t use it” (I reel off a list of ‘friends’ who, in fact, do use it)

* “It’s for younger people” (see previous point)

* “It’s only for vain people who enjoy taking selfies and I am not the human equivalent of a budgie staring into a mirror” (come on, who are you kidding – I’ve seen you check yourself out in the window when you think no one’s looking)

I’m pretty sure these same people dug their heels in when Facebook was still baby-faced, eventually caving and slinking into your Newsfeed, tail between legs.

Anyway, however light hearted and entertaining the platform may seem, this IPO is serious business. No major flotation of a US tech firm in recent decades has looked anything like as pricey as that of Snap.

Let’s make some comparisons: Facebook’s flotation in 2012 was initially considered a disaster when its shares fell below $38 per share shortly after the event, closing at $26.81 per share a week after the IPO. However the shares have now surged to $135.54 each.

At the other end of the spectrum is Twitter, which has fallen from its $75 grace in 2013 to around $16.

Snap back to reality

According to its prospectus, Snap has “incurred operating losses in the past, expect[s] to incur operating losses in the future and may never achieve or maintain profitability.” It is quite an admission.

The fact Snap is currently loss-making might not bother investors too much – revenue surges should see the company grow out of trouble. However, the valuation of around $24bn, announced yesterday (1 March), will mean a price-sales ratio of 55. Compare that to Google, which traded at 10 times sales in 2004, or Facebook which traded at 25 times sales in 2012, with the industry average at 2.8.

To justify this predicted valuation, sales will have to grow more than tenfold – that’s 63% per year, compared to a US IPO average five year revenue growth of 26%. Even Facebook and Google only averaged 47% and 57% respectively for their first five years as public companies.

So why is it getting such a high valuation? Because Snap is ‘sexy’, and I am not just referring to its initial function for sharing intimate selfies with a life span as short as the relationships they invoke.

Investors will pay high stakes on a ‘sexy’ gamble – one that may deliver windfall returns and therefore live up to the true definition of IPO, as some wags would have it: “It’s Probably Overpriced”.

Snap so sexy?

So, what makes Snap so sexy? Well, it boasts 158 million daily users, despite a growth sputter since the end of September, which the company attributes to competitors mimicking its products.

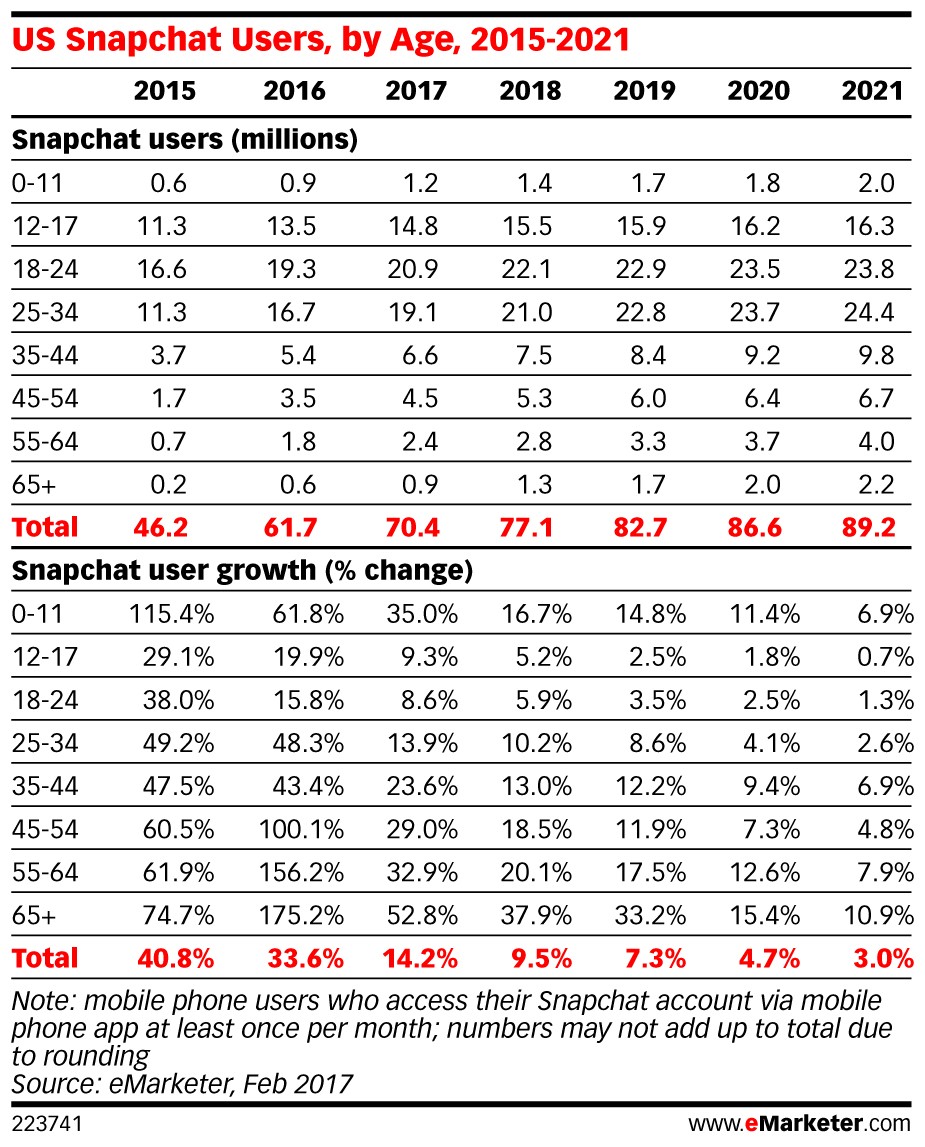

Also, the majority of its users are aged 18 to 34, with those under 25 visiting the app on average 20 times per day for a mean total of half an hour, dropping down to 12 visits for a total of 20 minutes in older users. While youth is good, it’s also a fickle core audience.

Less positive is the lack of major holding companies promising to spend big on the platform. “Although we have recently tried to establish longer-term advertising commitments with advertisers, most advertisers do not have long-term advertising commitments with us,” read the IPO filing. “Our efforts to establish long-term commitments may not succeed.”

Also, since Facebook revealed its errors measuring video content performance in 2016, advertisers may have concerns about the platform, which calculates its metrics internally and does not allow them validated by an independent third party.

Looking at revenue, it has shot up from around $60m in 2015 to $400m in 2016 – but it spent $500m, with more than $100m of that going on research and development. Still not sounding so sexy? Despite this, is has plenty of satisfied customers in the media world.

99 problems… but investors ain’t one

Anecdotally, at least Snap is a hot prospect.

MTV was among the first international brands to launch a Snapchat Discover channel back in January 2015 and MTV and Comedy Central vice president of digital Joanna Wells says it is now one of the most popular channels outside the US, attracting millions of video views a day.

“Snapchat forms a critical part of our social media strategy, which centres around the fact that we need to be everywhere our audience is,” says Wells, reinforcing the importance of resonating with fans in an authentic way, by approaching short form content in the same way the broadcaster approaches long form. “We are using Snapchat to be even bolder than we are on-air, to experiment and test new concepts and talent.”

In fact, MTV has invested so much in short form that it has recently launched MTV Studios to create original content and standalone short form series, with 7-10 episode sets available exclusively on MOTV International’s Snapchat Discover channel.

Aside from Discover content, MTV has also partnered on sponsored filters to tie in with key programming launches and generated good results from allowing artists like Zara Larsson and One Republic to take over the account for bespoke launches and events.

From the traditional publishing perspective, The New York Times senior vice president advertising and innovation Sebastian Tomich admitted he loves the platform. “I’m always impressed with each new feature they add,” he continues.

“They have an incredibly large base of young users, which is really valuable and their ad revenue growth seems to be sky-rocketing, but whether they can make that kind of next leap, like Facebook did, to become firmly in the mainstream, no one knows that yet.”

Yahoo UK managing director Nigel Clarkson is not an investor, but likes to champion all things digital, dismissing the idea of a digital “bubble”.

Referring to Zenith executive vice president Tom Goodwin’s comments on Airbnb being the biggest hotel business despite not owning any hotels, he continues “if you own the platform, you own the distribution, you own the people, then the content kind of comes”.

“On the one hand, Snapchat – the personal content which is shared is meant to be fun, it’s frivolous and brands are having fun trying to work out how they can get involved.”

Why agencies love ‘communitainment’

It is not only publishers and brands that are advocates of Snapchat. MediaCom head of paid social Renee Mellow speaks positively of the geo-filters which she find especially powerful for advertisers going after Millennials and young adults.

“We tested Snapchat earlier in 2016 and results were mixed, but over the holidays we saw King advertising on Snapchat which was a tip off that the ads were now working for app installs,” she says, also discussing B2B campaigns she has run on the platform. “These clients consider Snapchat a testing space and see the ‘full screen, sound on’ mobile placement as an opportunity to get better at creative for this environment.

Mellow continues anecdotally that, while brand content is not typically shared on platforms like Facebook and Twitter, she was initially surprised – and her clients delighted – by the additional reach that the lenses and filters drive.

“Most users are in the platform multiple times a day, so there is strong reach to users who ‘play’ with the filter, then a ring of incremental reach from ‘uses’ when a user sends a snap in a 1:1 message or posts to their story. Because its not a cluttered advertising space, there is cut through on the platform.”

UM global chief executive offer Daryl Lee argues that a strong Snapchat elevates everyone’s game. “Competition is extremely healthy, and they provide some competitive juice to the social media system,” he says.

Lee describes working with Snapchat on a couple of projects for Coca-Cola and for Sony Pictures for the launch of the James Bond film ‘Spectre’, where it required such a deep partnership and several rounds of changes.

“Some [movie] trailers really perform well on social media. They don’t perform on Snapchat. We had to create a truly custom experience that looked like nothing we had on any other channel; it took us 17 to 18 rounds.

“I think what Snapchat is doing is creating a new content experience, which, frankly, is exciting as it will make our work on Facebook and Twitter and LinkedIn more engaging. I like that. And there is a sense of more freedom to be silly and provocative. They are going to speed up the rate of innovation in the industry, which is great.”

While the safe money would probably be on a lower valuation, sometimes you have to take a gamble on a sexy investment, and history has shown that sometimes a promising tech start up can pay back big.

Like its card-based name sake, investing is a game of chance but the potential rewards are high. However, you can be sure this IPO is definitely the highest stakes betted on a game of Snap.